Overview

In M&A, structure drives everything.

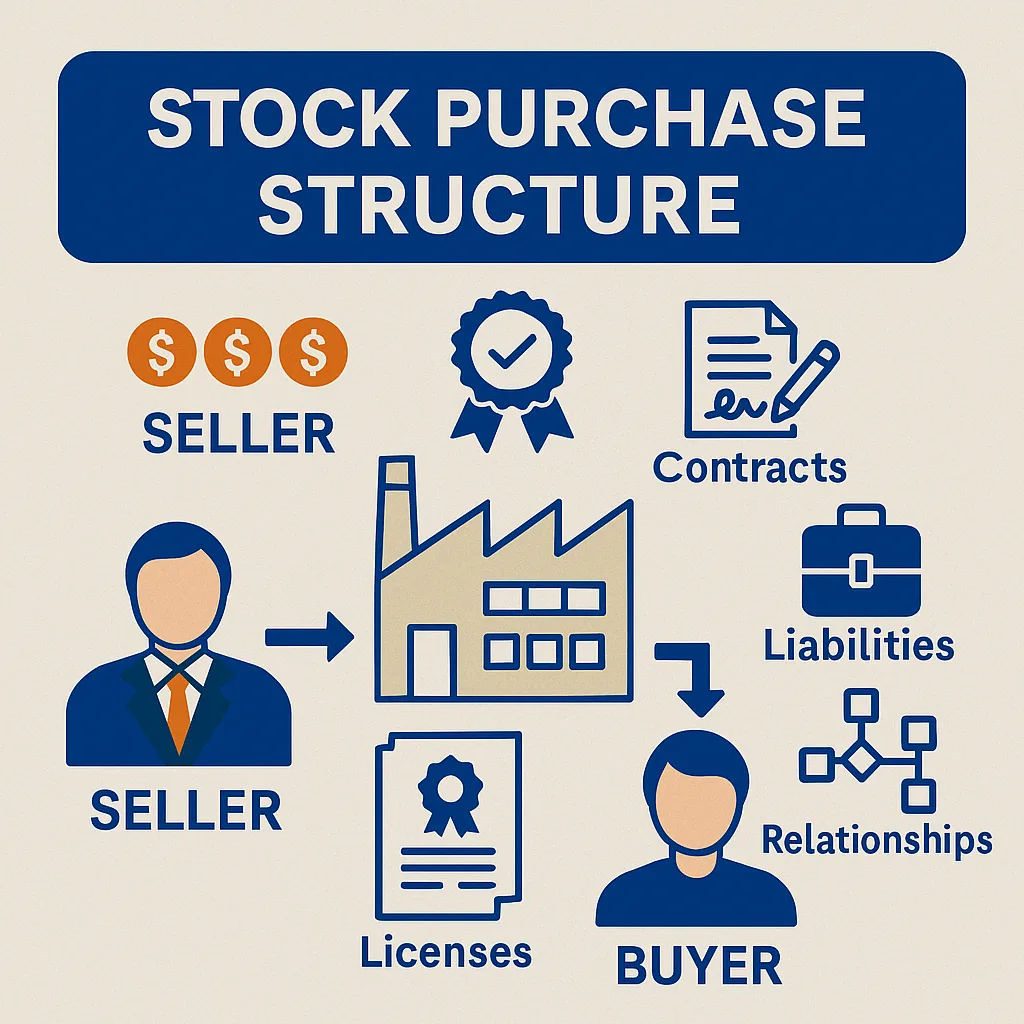

Whether you’re acquiring a business, preparing for an exit, or engineering a strategic consolidation, the choice between an asset purchase, stock purchase, or merger structure has significant downstream effects—on taxes, legal risk, closing complexity, post-closing obligations, and even cultural integration.

Each structure brings different pros and cons. And while the related contracts—typically an Asset Purchase Agreement, Stock Purchase Agreement, or Merger Agreement—capture the specific terms, they reflect broader strategy, risk tolerance, and business objectives.

This overview offers a side-by-side comparison of all three M&A structures, grounded in real-world deal execution and aligned with what matters to experienced acquirers, sellers, founders, and investors. Along the way, we’ll highlight how certain recurring deal terms—like working capital adjustments, indemnification, and representations and warranties—appear across each structure.